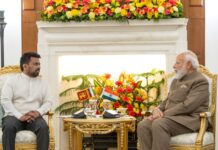

The Sri Lanka Budget 2025, presented by President and Finance Minister Anura Kumara Dissanayake, has been hailed as pro-business but with significant implementation challenges.

Advocata Institute Chairman Murtaza Jafferjee emphasized that while the budget reflects a market-oriented approach, successful execution will be crucial for tangible economic improvements. Economist Talal Rafi said the budget presentation of the new government has positive aspects which can improve the economy in the long term. He said the budget states that the government is expecting 5% GDP growth for 2025, the highest allocation has been made for the health and education budget and a development bank is to be initiated.

Advocata Institute Chairman Murtaza Jafferjee emphasized that while the budget reflects a market-oriented approach, successful execution will be crucial for tangible economic improvements. Economist Talal Rafi said the budget presentation of the new government has positive aspects which can improve the economy in the long term. He said the budget states that the government is expecting 5% GDP growth for 2025, the highest allocation has been made for the health and education budget and a development bank is to be initiated.

Key Highlights of the Budget

Salary Increases: Public sector employees will receive a minimum monthly salary hike of Rs. 15,750, phased over three years. The estimated cost of this increase is Rs. 325 billion.

Pensions Revision: Pensioners who retired before January 2020 will receive revised benefits in three phases.

Public Sector Recruitment: A strategic plan will see 30,000 new hires in essential services, with Rs. 10 billion allocated for this purpose.

Investment and Business Reforms: New legal amendments include the Investment Protection Act and the Public-Private Partnership Investment Management Act to foster a more business-friendly environment.

Tax Revenue Growth: The government aims for a 23% increase in tax revenue, targeting Rs. 4,960 billion in 2025, primarily through tax reforms and the liberalization of vehicle imports.

Sectoral Allocations: Rs. 35 billion for fertilizer subsidies and Rs. 78 billion for irrigation projects aim to boost agricultural productivity.

Economic and Market Reactions

The Colombo Stock Market responded positively, with the ASPI rising by 1.3% and a net foreign inflow of Rs. 777.4 million. Analysts view this as a reflection of improved investor confidence in the government’s economic policies.

Challenges and Concerns

Despite the positive outlook, experts have raised concerns about:

Revenue Targets: Achieving a 23% increase in tax revenue is ambitious, given past performance.

Debt Burden: While the budget projects a primary surplus of Rs. 750 billion, the overall budget deficit remains high at 6.7% of GDP, exceeding the IMF-recommended 5.2%.

Public Sector Efficiency: The budget recognizes the need to streamline government agencies, but its effectiveness remains uncertain.

SriLankan Airlines Bailout: A controversial Rs. 20 billion allocation to settle the airline’s legacy debt has sparked debate over the effective use of public funds.

A Policy Shift Towards Growth

The government’s focus on expanding Free Trade Agreements (FTAs), enhancing ease of doing business, and attracting Foreign Direct Investment (FDI) signals a departure from traditional policies. The proposed establishment of privately run industrial zones and a new development bank also aligns with this strategic shift.

The following new laws and legal amendments are planned to be introduced in 2025 in furtherance of the policies of the new Government as per the Budget 2025 presented yesterday by President Anura Kumara Dissanayake.

The Act on the Exchange of Information between State Institutions

Investment Protection Act

State Business Enterprises Management Act

Public-Private Partnership Investment Management Act

Statistics Act

Valuation Act

Public Asset Management Act

Public Procurement Law

Micro Finance and Credit Regulatory Authority Act

Strengthening of Anti-Money Laundering and Countering the Financing of Terrorism

Key tax moves in Budget 2025

Personal Income Tax

The monthly tax-free threshold will be increased from Rs. 100,000 to Rs. 150,000, increasing the annual tax-free allowance to Rs. 1.8 million.

The first band of Personal Income Tax (PIT) taxed at 6% will be expanded to Rs. 1 million. The AIT rate on interest income of 5% will be increased to 10% on those with monthly interest income exceeding Rs. 150,000.

Corporate Income Tax

Certain exports of services which are currently exempt from income tax will be subject to income tax at the rate of 15%.

VAT

The Simplified Value Added Tax (SVAT) system will be replaced by a risk-based refund system. The Commissioner General of Inland Revenue will specify the conditions to issue refunds through the Risk-based Refund Scheme.

Services provided through digital platforms will be subject to VAT and provisions will be introduced to the VAT law and regulations to be issued on registration, charging, collection, filing of returns etc.

Input tax on capital goods, such as machinery, equipment, or vehicles imported for projects where VAT at the time of import is deferred, will not be allowed as a deduction as input VAT.

It is mandatory for all VAT-registered persons to use Point of Sale (POS) machines.

VAT exemptions

Supply of goods and services by/to any business identified and approved as a “business of strategic importance” under the Colombo Port City law.

Import of packing materials for the use of packing of pharmaceuticals or ayurvedic medicines manufactured in Sri Lanka.

Yogurt and other dairy products

Stamp Duty

Stamp Duty on any instrument relating to the lease or hire of any property will be increased from 1% to 2% on the aggregate lease or hire payable for the entire term with effect from 1 March 2025.

Social Contribution Levy

The exemption for petrol, diesel, or kerosene will be available for wholesale and retail sale of such articles as well.

The exemption on “transportation of goods and passengers” will be expanded to include services provided in relation to international transportation by container terminal operators.

Any machinery or equipment imported or purchased locally by any institution which has entered into an agreement with the Ceylon Electricity Board (CEB) prior to 18 February 2025 for the purpose of generating electricity will be exempt.

Sri Lanka’s 2025 Budget sets ambitious targets to stimulate economic growth, enhance public sector efficiency, and attract investment. However, its success will hinge on effective implementation and the government’s ability to navigate fiscal constraints while ensuring sustainable development.

(by Team Newsnow)