Sri Lanka has officially signed a new bilateral debt restructuring agreement with the United Kingdom, marking another key step in its efforts to recover from a sovereign default. The Ministry of Finance announced that the agreement covers restructured debt totaling $86,068,439.80 US dollars and 582,940,944.31 Japanese yen.

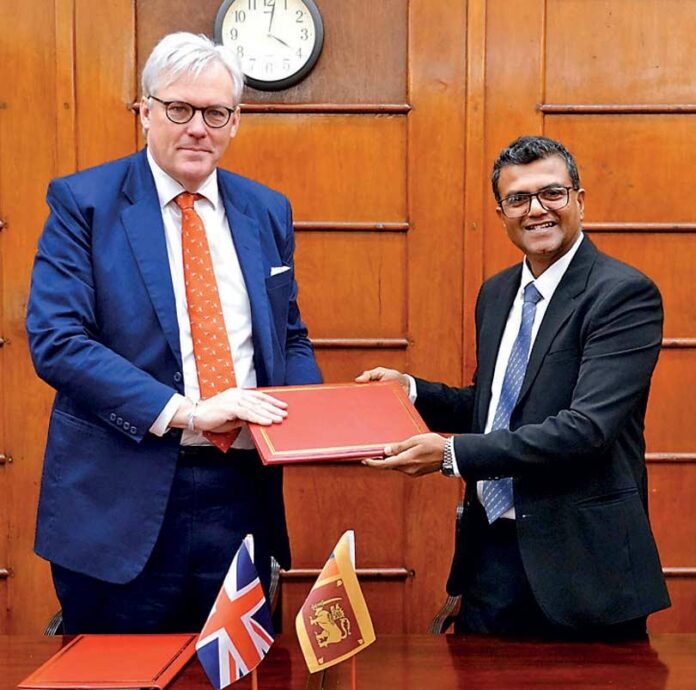

The signing of the diplomatic notes took place between Andrew Patrick, the British High Commissioner to Sri Lanka, and Harshana Suriyapperuma, Secretary of the Ministry of Finance, Planning, and Economic Development. According to a ministry statement, the agreement is expected to “pave the way for developing further the deep and longstanding bilateral relationships” between the two nations.

This agreement follows similar deals that Sri Lanka has finalized with other major bilateral creditors as part of its ongoing debt restructuring process. In March 2025, Sri Lanka signed a $2.5 billion debt restructuring deal with Japan, the first with a member of the Official Creditor Committee (OCC).

Prior to that, in June 2024, Sri Lanka reached a crucial understanding with its key bilateral creditors, including the OCC (co-chaired by Japan, France, and India) and separately with the Export-Import Bank of China. These agreements cover a total of approximately $10 billion in debt, a significant portion of the country’s external obligations.

Early in July, Sri Lanka has restructured approximately 517 million Saudi Riyal (SAR) of debt with the Saudi Fund for Development (SFD). This restructuring was achieved through the signing of bilateral amendatory loan agreements.

The successful restructuring of bilateral debt is a vital component of Sri Lanka’s IMF-supported economic recovery program, which aims to restore debt sustainability and stability to the island’s economy after it defaulted on its foreign debt in April 2022.