Human Rights Watch (HRW) has accused successive Sri Lankan governments of pursuing destructive tax policies that played a central role in the country’s 2022 economic collapse and continue to deprive citizens of essential public services.

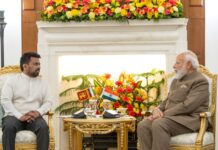

In a 101-page report titled “Tax Giveaways, Struggling Schools: How Low Taxes Drove Sri Lanka’s Economic Crisis and Squandered its Education Lead,” HRW said the current system favours corporations and the wealthy while failing to generate adequate public revenue. The organization urged the Government of President Anura Kumara Dissanayake to introduce a progressive tax reform that prioritizes equity and social investment.

“For decades, Sri Lanka has been hostage to economic policies that starve its government of revenue and reflect a myopic focus on GDP growth,” said HRW Senior Economic Justice Researcher Sarah Saadoun. “These ruinous tax policies have left education spending far behind, turning Sri Lanka from a global leader in public education to a laggard.”

According to the report, public spending on education has fallen from 3–5% of GDP in the decades following independence to just 1.5% in 2022, among the lowest in the world. HRW said this decline has forced schools to charge fees for basic resources, deepening inequality and undermining children’s right to free education.

The group also linked Sri Lanka’s low tax revenues to the 2022 debt default, citing job losses, inflation, and a prolonged social crisis. HRW noted that tax exemptions granted to companies cost the Treasury an amount equivalent to 56% of total revenues—nearly three times the national education budget—while 80% of tax income came from goods and services, placing a disproportionate burden on low-income households.

HRW traced the roots of the crisis to economic liberalisation in the late 1970s, saying the situation was worsened by former President Gotabaya Rajapaksa’s 2019 tax cuts, which “dealt a devastating blow to revenues.”

“The Government should finally establish a progressive tax system and adequately fund education and other public services that benefit all Sri Lankans,” Saadoun said.

HRW urged the government to end costly corporate tax exemptions, introduce a wealth tax, and strengthen tax enforcement, warning that global “tax competition” among developing nations is fuelling a “race to the bottom” that undermines human rights.

While acknowledging limited relief measures—such as a Rs. 6,000 monthly transfer to poor families—HRW said the Dissanayake administration has yet to significantly expand the education budget. The organization called on the government to raise education spending to 4–6% of GDP in line with international standards and align fiscal policy with human rights obligations to invest in education, health, and social protection.